“Risks and opportunities for 2026”

Stocks

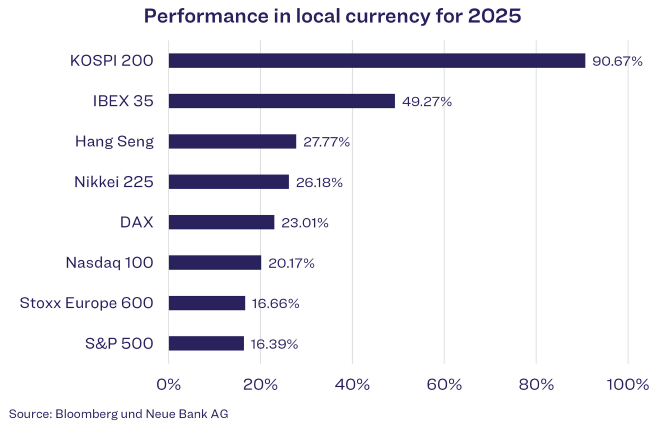

In 2025, it was a good year for stocks, but once again marked by a high level of market concentration. Major stock indices reached new all-time highs, yet were driven by only a few heavyweights and specific sectors. In particular, stocks from the fields of Artificial Intelligence, Finance, Defense, Utilities, and Commodities acted as the main drivers. Classic industrial stocks and small-cap stocks, on the other hand, were among the losers or underperformers. Among the well-known indices, the South Korean KOSPI 200 showed the strongest performance. Fueled by the AI euphoria, the index rose by over 90%, with two stocks—Samsung Electronics and SK Hynix—contributing significantly, accounting for over 45% of this development. Europe also performed well, with the Spanish IBEX 35 leading the way, rising by nearly 50%. The positive performance was largely driven by the heavily weighted financial sector, which was responsible for the majority of the gains. As shown in the following chart, the US market, with a gain of around 16%, was among the laggards in the international comparison.

Considering the significant weakness of the US dollar, the returns for Swiss and European investors were overall rather subdued. The dollar lost around 13% in value both against the Swiss franc and the euro. Although the S&P 500 rose by 16%, currency-adjusted returns were only about 3%. Overall, a few winners in 2025 overshadowed a large number of underperformers. The question arises whether this pattern will continue in 2026. Risks include particularly the high valuations in the stock market and the possibility of the AI bubble bursting. A significant decline in technology stocks could lead to investment cuts, which in turn could weigh on the broader market, as many companies—also outside the IT sector—are now benefiting from AI investments. Considering the significant weakness of the US dollar, the returns for Swiss and European investors were overall rather subdued. The dollar lost around 13% in value both against the Swiss franc and the euro. Although the S&P 500 rose by 16%, currency-adjusted returns were only about 3%. Overall, a few winners in 2025 overshadowed a large number of underperformers. The question arises whether this pattern will continue in 2026. Risks include particularly the high valuations in the stock market and the possibility of the AI bubble bursting. A significant decline in technology stocks could lead to investment cuts, which in turn could weigh on the broader market, as many companies—also outside the IT sector—are now benefiting from AI investments. However, there are also opportunities. The topic of Artificial Intelligence is likely still in its early stages of development and could continue to provide market impulses over a longer period, with other sectors increasingly benefiting as well. Furthermore, earnings growth of around 14% is expected for the US market in the coming year, which will not be solely driven by the “Magnificent 7,” but by the broader market. These factors support the possibility of positive stock markets and increasing market breadth in 2026. In addition to these aspects, there are other opportunities and risks that could influence the development of the stock markets. We will address these in more detail in the following sections.

Economy

Based on the following scenario, a recession may occur in the US: Private consumption declines due to falling savings and rising job losses. At the same time, interest rates and mortgage rates remain high, putting pressure on real estate prices and increasing borrowing costs. However, we currently assess this scenario as unlikely and instead expect the continuation of the so-called K-shaped economic development. In such an economic environment, individual sectors, companies, and population groups will increasingly develop differently. In the upper arm of the K-curve (recovery), certain sectors—particularly technology, software, and financial services—along with high-income households, which quickly recover and show significant growth, will benefit. In contrast, in the lower arm (downturn), other sectors such as hospitality, retail, or tourism will either stagnate or lose further economic substance. Low-income households are particularly affected by this development. The K-shaped economy thus exacerbates social and economic inequality. While wealthy groups benefit from rising asset values, others suffer from a loss of purchasing power and increasing debt. This economic trend characterized 2025 and is likely to continue in 2026, further intensifying the divergence between outperformers and underperformers in the stock markets.

Bonds

On May 15, 2026, Jerome Powell’s term as Chairman of the US Federal Reserve (Fed) will end. Although Powell was appointed during US President Donald Trump’s first term, Trump repeatedly criticized the work of the Fed Chairman during his second term. From his perspective, Powell followed too restrictive a monetary policy and should have significantly lowered interest rates. Against this backdrop, the US President is considering various potential successors who are politically aligned with him in order to increase his influence on monetary policy. However, this creates the risk that the Federal Reserve could partially lose its independent, data- and science-based approach to monetary policy, and that rate cuts could become more politically motivated. Such an approach would be problematic in the medium term and could lead to a sharp increase in inflation again, negatively impacting the stock markets. A look at the break-even inflation rate—reflecting the difference between nominal government bonds and inflation-protected bonds—recently showed declining inflation expectations. This suggests that inflation in 2026 is expected to remain within a reasonable range. Combined with the expected further interest rate cuts, this increases the attractiveness of the stock market. Additionally, the market has become accustomed to Donald Trump’s policies over time and has developed a certain resilience to political uncertainty.

Currencies

The US Federal Reserve is quietly and steadily loosening its monetary policy. Specifically, the Federal Reserve plans to purchase approximately USD 40 billion in short-term US Treasury bills (T-bills) each month in order to maintain bank reserves at adequate levels. Officially, this is not considered quantitative easing; however, it is still injecting additional liquidity into the financial system, which generally supports the US stock market. The funds flow into the financial cycle via money market funds and the repo market. In this way, the money supply can be indirectly expanded without the Fed explicitly classifying these measures as monetary easing. As a result, the share of short-term debt in the US federal budget is set to rise above 22%. Against this backdrop, a weaker US dollar can be expected in 2026. Accordingly, we maintain our partial hedging in CHF and EUR mandates. In particular, the Swiss franc is likely to remain in strong demand and is unlikely to show significant weakness.

Alternative Investments

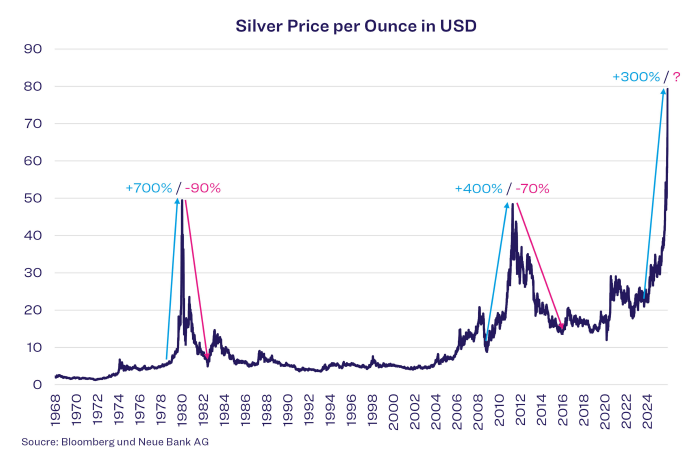

The price of silver experienced a historic rally in 2025, briefly rising above USD 80 per ounce, which corresponds to a return of more than 175%. The main driver of this development was a structural supply deficit: industrial demand—especially from the fields of photovoltaics and artificial intelligence—exceeded the stagnating supply from mining for the fifth consecutive year. Additionally, the US Federal Reserve’s interest rate cuts increased the appeal of the precious metal to investors, while geopolitical tensions further boosted demand for tangible assets. For 2026, opportunities remain, especially if the global energy transition gains momentum and silver supply, due to its key role in the electronics industry, remains tight. A persistently weak US dollar could further support the silver price. However, there are significant risks. A potential economic slowdown could abruptly curb industrial demand. Moreover, after the exceptionally strong rise in 2025, there is a risk of substantial profit-taking and a significant price correction, especially by speculative market participants. Historically, there have been two similar phases of extreme price increases since 1950, followed by strong corrections.

Between these peak phases, there were often multi-year sideways movements during which hardly any performance was achieved. The current market environment shows parallels to these historical patterns, which increases the risk of another correction. At the same time, it should be noted that silver today has a significantly higher industrial importance than in previous cycles. The crucial question therefore remains to what extent the recent price increase is fundamentally supported by industrial demand and how strongly it has been influenced by speculative factors.

Downloads