“Why Now Is a Good Time to Invest in Cat Bonds

Alternative Investments

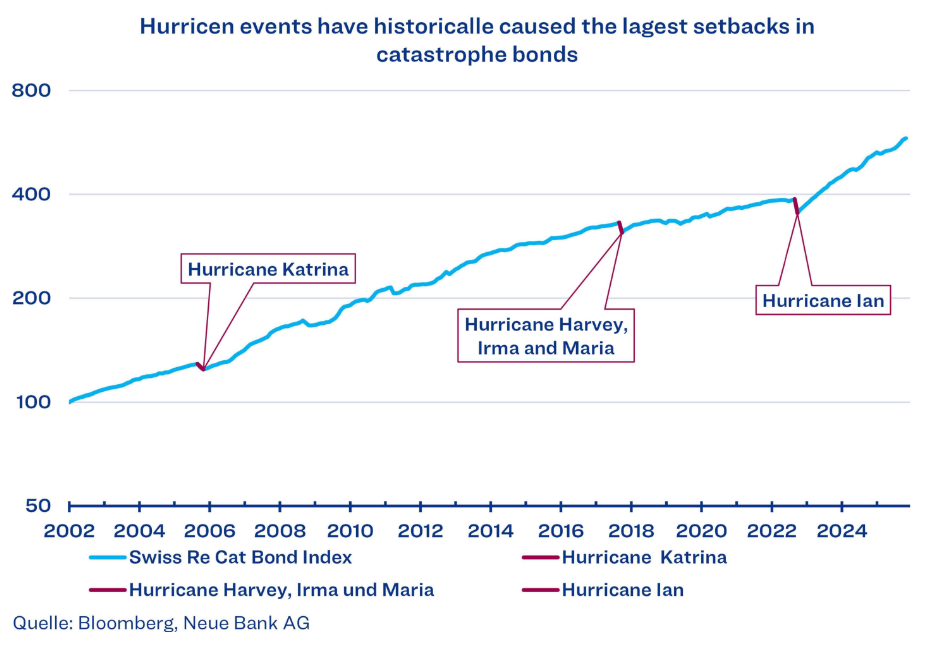

Catastrophe bonds (Cat Bonds) are among the most compelling instruments in the field of alternative investments. The market becomes particularly attractive immediately after the end of the hurricane season, as a large share of the global Cat Bond volume provides protection against hurricane events in the United States. From November onward, this risk is significantly reduced for several months. As a result, this period is especially favorable for entering the market: risk premiums remain in place, while the likelihood of severe storm events in the Atlantic stays minimal until early summer.In addition to this seasonal relief, several structural factors speak in favor of Cat Bonds. Yields are generally high because individual bonds carry the risk of a total loss in the event of a catastrophe. This elevated risk is compensated by attractive coupons, which typically offer a substantial margin over traditional investment-grade corporate or government bonds.The key advantage for investors, however, lies in the nature of the underlying risk. It does not correlate with the usual drivers of financial markets-such as economic cycles, interest-rate developments, or geopolitical tensions-but is tied to specific natural events. Since, for example, hurricane and earthquake risks occur independently of each other, Cat Bonds offer excellent diversification potential. This low to near-zero correlation allows portfolios to be structured in a way that achieves robust risk dispersion.That said, hurricanes have caused occasional setbacks over the past 20 years. The most significant occurred in 2022 with Hurricane Ian, which resulted in a 9% monthly price decline (in USD)

The historical track record clearly demonstrates how reliably Cat Bonds can deliver their strong diversification benefits. During periods of severe financial market turmoil-such as the 2000-2003 dot-com crash, the 2008/09 financial crisis, the 2020 COVID-19 shock, or Russia’s invasion of Ukraine in 2022-Cat Bonds remained remarkably stable and developed largely independently of movements in equity and bond markets. For broadly diversified client portfolios, this provides a genuine diversification benefit that reduces overall risk without compromising long-term returns.

Economic Outlook

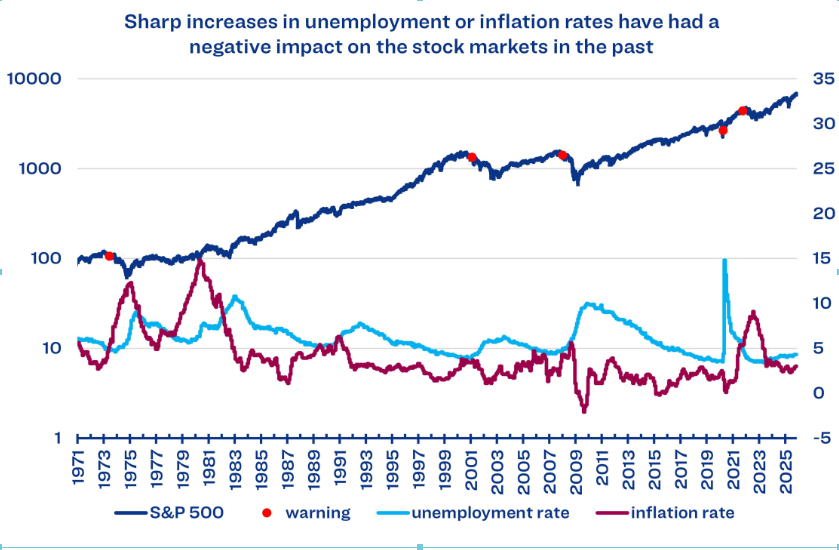

Economic activity and U.S. equity market performance are closely intertwined- even though they do not always move in perfect lockstep. It is therefore no surprise that investors monitor relevant indicators closely to detect not only the general economic trend but also potential turning points in the markets at an early stage. Today, our focus is on two key factors: inflation and the labor market.

Historically, the following rule of thumb applied: as long as unemployment remained below 5% and either the inflation rate (above 5% per year) or the unemployment rate (more than 0.25% per month) rose sharply, equity markets often experienced significant pullbacks (see the red warning markers). At present, unemployment figures are indeed increasing, but at a very moderate pace. Inflation also remains above the Federal Reserve’s 2% target, yet clearly below the critical 5% threshold. This seemingly stable environment provides a fundamentally solid basis for the upcoming investment year. The key question, however, is whether this stability will persist. One potential source of disruption could be the forthcoming monetary easing. Markets are currently pricing in an optimistic three to four rate cuts by the end of next year. Given that inflation is already above target, such a policy stance is not without risk. Added to this are newly introduced tariffs on imports from around the world, which are likely to trigger additional price increases. The combination of potentially more accommodative monetary policy and tariff-induced price pressures raises the risk that inflation could again drift further away from the Fed’s target corridor. It will be important to monitor developments closely.

Currencies

This leaves the Fed facing a delicate balancing act in 2026, caught between political pressure and the need to preserve the credibility of its monetary policy. A loss of confidence could not only push long-term yields higher but also place noticeable downward pressure on the U.S. dollar. Our currency indicators point in the same direction, and we continue to hedge part of the USD exposure in our EUR and CHF mandates through forward currency contracts.

Equities

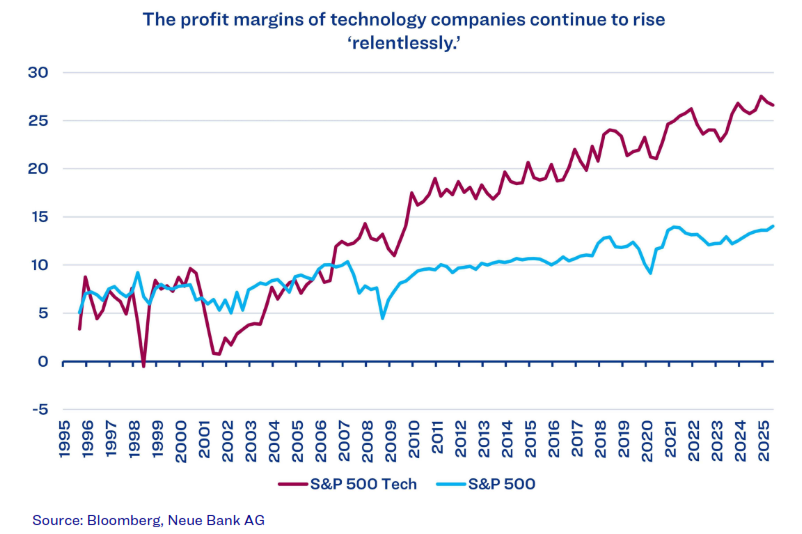

We have discussed the topic of today’s elevated valuation levels on several occasions in this publication. Today, however, we approach the subject from a different angle-the perspective of profit margins. The assumption that margins gradually revert to a long- term average (mean reversion) has a robust economic foundation and is rooted in classic competitive dynamics. High margins attract new entrants, intensify competition, and put pressure on prices until profitability returns to more normal levels. Historically, this pattern was clearly observable in the United States over many decades. In recent years, however, this picture has changed-driven largely by the structure of the digital economy. Large technology companies operate in markets shaped by network effects, extremely low marginal costs, and massive economies of scale. As the number of users increases, the value of their services rises (network effects), making it increasingly difficult for new competitors to gain market share. At the same time, the cost of serving each additional digital customer is negligible (low marginal costs). This combination entrenches lasting market power and creates significant barriers to entry. As a result, certain tech giants are able not only to maintain their high margins but in some cases even expand them.Warren Buffett identified these exceptional cases long ago, pointing out that companies with strong “economic moats”-that is, sustainable competitive advantages such as brand strength, proprietary technology, a structurally low-cost base, or high customer loyalty-can defy the forces of mean reversion.

A closer look at margin trends underscores the outperformance of the technology sector. While the broader market has seen only a moderate expansion in margins- driven largely by the tech sector itself-technology companies have been able to increase their profitability metrics steadily and significantly.This divergence raises a crucial strategic question regarding the sustainability of this development: to what extent can further improvements in operational efficiency and profitability realistically be achieved? The prevailing market view suggests that as long as margins continue to expand, premium valuations-i.e., higher multiples-remain fundamentally justified.Against this backdrop, our tactical positioning remains unchanged: we continue to maintain a slight overweight in equities.

Downloads