“Does a low unemployment rate signal a stock market correction?”

Economy

A study examined which types of news are particularly relevant for financial markets. The U.S. labor market report was found to be the most influential. This provides sufficient reason to take a closer look in this issue at the development of the U.S. unemployment rate and to assess its significance for the economy and financial markets. Rising unemployment is often associated with an economic slowdown or a recession. Recently, a gradual but moderate increase in unemployment has been observed. Historically, however, recessions are typically preceded by much steeper increases. Against this backdrop, current developments point less to an imminent crisis and more to a mild cooling, allowing the U.S. economy to maintain its growth trajectory for the time being.

Equities

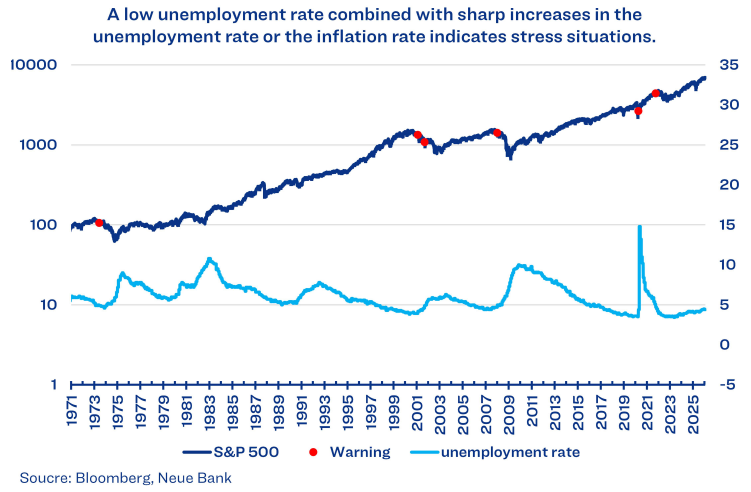

Historical data reveal an interesting relationship between the U.S. unemployment rate and future stock market returns, as measured by the S&P Contrary to intuition, equities do not necessarily perform best when the economy is booming and unemployment is very low. Instead, strong stock market performance often occurs during periods when unemployment is higher. When the unemployment rate was below 5%, the S&P 500 generated an average return of only about 6.1% in the following year. Returns were significantly higher when unemployment was moderate or elevated. During periods with unemployment between 5% and 6%, the average increase in the S&P 500 in the subsequent year was around 12.9%. A similar pattern emerged when unemployment ranged between 6% and 8%, with average returns of approximately 13.1%. The effect was most pronounced during periods of very high unemployment (above 8%), when the S&P 500 rose by an average of 20.1% in the following year. Overall, historical data indicate a positive correlation between rising unemployment and the likelihood of positive equity market performance. While a positive stock market year followed low unemployment in roughly two-thirds of cases, this success rate increased to around 80% during periods of moderate to high unemployment. When unemployment was very high, the S&P 500 delivered positive returns in more than 95% of cases in the subsequent year. This pattern is largely driven by the business cycle. Higher unemployment often coincides with challenging economic conditions, when pessimism prevails and stock prices have already declined significantly. It is precisely during these hases, however, that economic recoveries often begin—supported by interest rate cuts and fiscal stimulus—providing strong tailwinds for equity markets. Conversely, very low unemployment typically signals a late stage of the economic cycle, when conditions are already favorable and much of the positive outlook is priced into stock valuations.

With a current unemployment rate of 4.4%, we are operating in a range in which the 12-month performance of the S&P 500 was historically negative in roughly one-third of cases. Accordingly, there is a certain risk of stock market corrections. At the same time, however, the probability of further price gains is about twice as high, making the overall risk–return profile still appear attractive. The key question, therefore, is whether additional factors emerge that could trigger heightened stress in financial markets. Our analyses show that, in particular, a sharp increase in the unemployment rate of 0.25% per month—equivalent to an annualized rise of 3 percentage points—or a significant increase in inflation to above 5% per annum can act as such triggers (see red warning signals in the chart). At present, neither of these conditions is met. From this perspective, at least, no immediate obstacles to further market advances are apparent.

Bonds

The U.S. labor market also provides important signals for the bond market. When equity markets enter a crisis mode, investors are often advised to reduce credit risk and adopt a more defensive positioning. A rising unemployment rate can serve as an early indicator of an economic slowdown, affecting both corporate bonds and interest rate markets. Beyond labor market developments, the actions—and in particular the communication—of the U.S. Federal Reserve play a central role for bond markets.Recently, additional attention was drawn to President Trump’s decision to nominate Kevin Warsh as the new Chair of the Federal Reserve. As recently as December, Kevin Hassett, one of Trump’s economic advisers, had been considered a potential candidate. However, since Trump was unwilling to forgo Hassett’s services in the White House, Warsh increasingly moved into focus and ultimately received the nomination. Kevin Warsh previously served as a member of the Federal Reserve Board and brings experience both as a government adviser and as a seasoned finance professional. He is widely regarded as a clearly conservative monetary policymaker and has repeatedly voiced criticism of the highly accommodative monetary policy pursued since the global financial crisis. In particular, he views the Federal Reserve’s significantly expanded balance sheet as a long-term risk to financial stability. While Warsh generally advocates lower policy rates, he ties this stance to a call for a consistent reduction of the central bank’s balance sheet and a stronger focus on the Fed’s core mandate. He also argues that inflation is driven less by monetary factors and more by expansive fiscal policy and rising government spending. This view partially departs from the prevailing monetary policy consensus but makes him an attractive choice for President Trump. His position is further supported by strong ties within the financial elite and his personal financial independence. Over the medium term, this profile could favor a steeper yield curve, increasing the importance of fundamental credit risks for investors.

Currencies

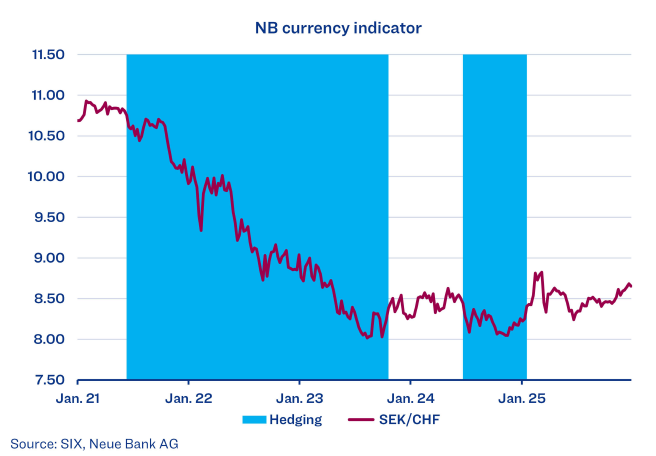

In this issue, we turn our attention to a currency that often receives less focus in our region but managed to appreciate even against the Swiss franc (CHF) over the past year: the Swedish krona (SEK). At present, Sweden offers an attractive profile for two main reasons. First, the Swedish economy has demonstrated remarkable resilience. While major European economies continue to struggle with sluggish momentum, leading indicators point to a continuation of Sweden’s recovery. Second, at the end of January the Swedish central bank (Riksbank) signaled that the cycle of interest rate cuts has likely reached its trough at a level of 1.75%. This monetary policy stability provides the SEK with solid support relative to other European currencies. The positive outlook has been further reinforced by a recent easing of trade tensions. At the World Economic Forum in Davos in January 2026, a significant breakthrough was achieved in the dispute over Greenland. As part of this agreement, previously threatened U.S. tariffs on European partners were withdrawn —an important relief, particularly for Sweden’s export-oriented industrial sector. As a result, a key source of uncertainty has been removed, significantly expanding the scope for further strengthening of the SEK.

After our currency indicator signaled a defensive stance from mid-2021 and successfully mitigated the downtrend until the third quarter of 2023, technical analysis now also suggests that further recovery in the SEK is possible.

Alternative Investments

In early February 2025, as part of our momentum strategy, we purchased an ETC on gold. At that time, the price per troy ounce was around USD 2,800. Approximately one year later, in January 2026, gold reached a peak of over USD 5,400, corresponding to a price increase of up to 93%. Due to the weakness of the USD, the return in CHF was around 61% and in EUR approximately 65%, which, while lower, still represents a highly satisfying gain. The future trajectory, of course, cannot be predicted with certainty. As mentioned, the entry was made within a strategy in which we regularly compare the momentum indicators of various alternative investments and allocate capital to the one with the highest reading. Gold continues to exhibit the strongest momentum, and therefore we remain invested. At the same time, we are aware that after such a strong rally, corrections can occur at any time, as observed during the last two days of January. To manage risks, we regularly perform rebalancing whenever a position grows too large within the portfolio, bringing the gold allocation back to its original weight.

Downloads