“Interest rate policy in limbo”

Economy

The US Federal Reserve and its chairman Jerome Powell are not to be envied these days. The US has been in shutdown since 1 October because Congress has been unable to reach agreement on the budget for the current fiscal year. During a shutdown, non-essential government services are suspended and many government employees are furloughed until an agreement is reached. This also affects the authorities responsible for compiling macroeconomic data. Only inflation data has been released recently, showing a rise to three per cent (August: 2.9 per cent). However, the accuracy of this data is being questioned due to the reduced staffing levels in the US administration. As a result, Jerome Powell currently has a limited view of the situation. The Fed Board needs further data in order to continue its conscientious work. Nevertheless, the US Federal Reserve has lowered its key interest rate for the second time this year. It reduced the interest rate by 0.25 per cent to a range of 3.75 to 4.0 per cent. However, with a view to the next meeting in December, the Fed chairman added that the Fed could pause interest rate cuts again if uncertainties regarding economic data persist.

Bonds

Donald Trump’s ‘Big Beautiful Bill’ budget bill is estimated to increase US national debt by an additional $3.3 trillion over the next 10 years, bringing it to over $41 trillion. Many fear that this renewed debt binge will increase the risk of US national bankruptcy. But how realistic is this scenario? The additional debt forecast accounts for less than ten per cent of current debt. In relation to annual economic output, the current debt level stands at 124 per cent and, according to a study by JP Morgan, will rise to 140 per cent. Japan, for example, has had a much higher ratio of 230 per cent for many years. Like Japan, the US is indebted exclusively in its own currency, and if all else fails, the Fed could buy US government bonds from the market at any time, causing prices to rise and pushing down yields. However, the US is not alone when it comes to increasing debt. Even Germany, the model pupil, has approved a EUR 500 billion investment package to be financed by new debt. There are hardly any countries that are not following this path of ‘debt accumulation’. This global debt rally is shifting the financial burden onto future generations. Although the acute bankruptcy of a major economic nation is unrealistic, we are also critical of the longerterm outlook and have reduced our exposure to government bonds in favour of corporate bonds.

Shares

Big Tech bubble, AI bubble, Dotcom 2.0 – these are just a few of the headlines that have been constantly haunting the media lately, fuelling fears of an impending crash in technology stocks. Is this justified or just scaremongering? The current figures paint a mixed picture. The S&P 500 ex-technology index has risen by 13 per cent year-on-year, while profits have increased by only 6.4 per cent. Traditional sectors such as consumer staples and energy are struggling, with profits down 3.1 per cent and 3.3 per cent respectively. In cyclical consumption, too, the estimated P/E ratio for 2025 is high at 29.6, which is as high as for tech companies, but without comparable profit growth. For the tech sector, analysts expect profit growth of 20.4 per cent in 2025, driven primarily by the chip industry with plus 44 per cent. The estimated P/E ratio in the IT sector is high at 29.8, but is in line with earnings growth. The traditional sectors of the ‘old economy’ currently carry the higher valuation risk, while the large technology companies paradoxically appear more stable. The overall market (S&P 500) has become expensive with an estimated P/E ratio of 22.6, which is well above the five- and ten-year averages (19.9 and 18.5).

Currencies

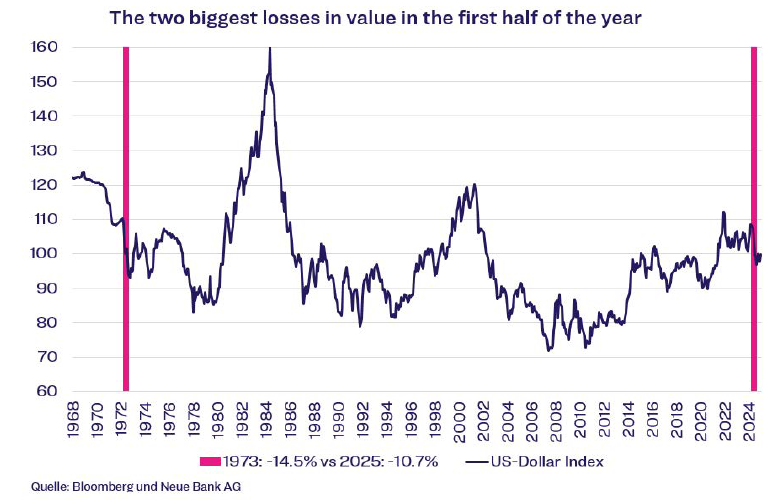

From the beginning of the year to the end of June, the dollar index, which tracks the performance of six currencies against the US dollar, lost just under 11 per cent.

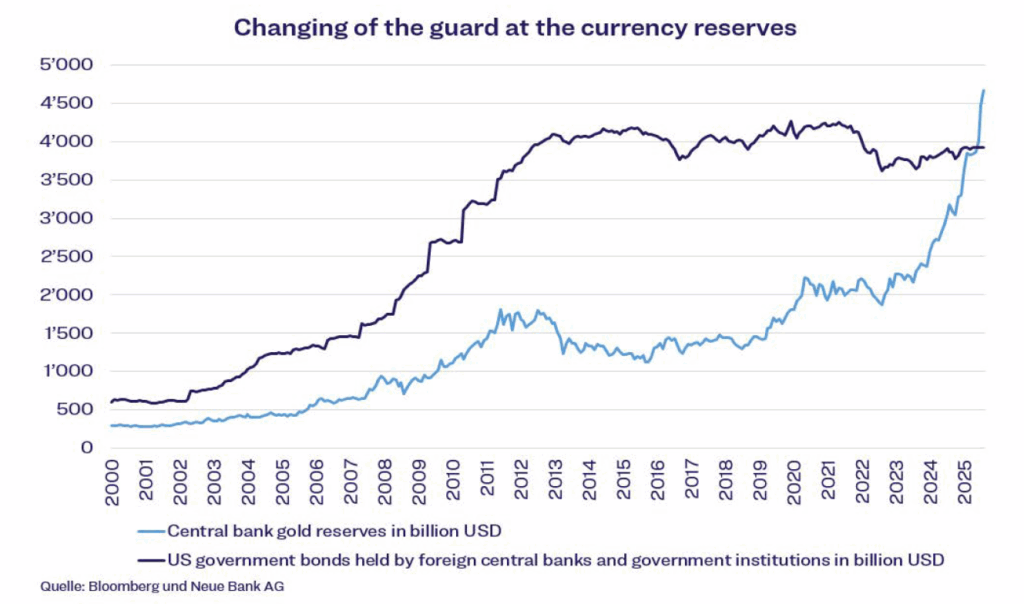

This is the sharpest decline within a six-month period since 1973. However, since hitting its low for the year, the US dollar has stabilised and is now trending sideways. Will the weakness continue or will there be a recovery? The aforementioned ‘Big Beautiful Bill’, which is accompanied by a growing mountain of debt, and the US President’s policies, which do little to inspire confidence, give cause for scepticism. On the other hand, the economic strength of the country speaks in favour of the US dollar. The US generated more than a quarter of global economic output and a third of global corporate profits. Above all, however, there are no adequate alternatives. The world’s second-largest economy, China, is a one-party dictatorship with largely closed capital markets. Switzerland and Norway, with their robust currencies, offer far too little liquidity to be considered as a substitute for the US dollar. In our view, the USD’s status as the global reserve currency is not in immediate danger, but its importance could nevertheless decline. Investors may come to believe that the dollar component of a broadly diversified portfolio should be lower in the future. Countries such as China have already begun to make their foreign exchange reserves less dependent on the US dollar by purchasing gold.

Alternative investments

There have been increasing reports of a gold crash in recent days. However, we do not see a crash, but rather a normal correction in an intact upward trend. Gold reached its peak on 20 October at a price of USD 4,356 per ounce, representing an increase of 65 per cent since the beginning of the year. The latest rise, which began at the end of August, was very steep and rapid. Such extreme movements are usually followed by a correction phase. The gold rally prompted us to realise profits and reduce our gold position to the strategic quota. Gold remains in demand given the global uncertainties. An important factor is the weak US dollar, but also the extraordinary times with geopolitical conflicts and a significant increase in global government debt. In this environment, the yellow precious metal shines in its role as a safe haven against currency risks and inflation. The value of global central banks’ gold reserves now exceeds the total amount of US government bonds held by central banks and government institutions abroad.

There are many indications that the price of gold will continue to rise,

and we believe that the current correction phase represents a good

opportunity to enter the market. This is particularly true for investors

who have not yet invested in gold, or who have only invested a small

amount.

Downloads